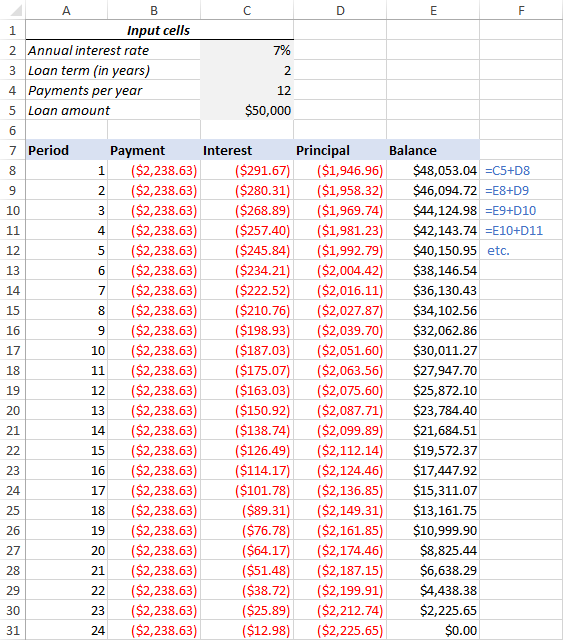

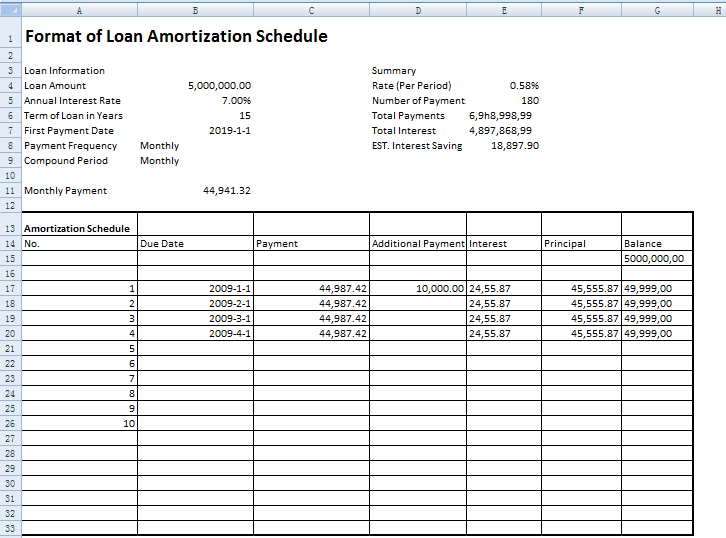

Keep in mind that there may be fees and other charges added to the total payable amount, such as Lenders Mortgage Insurance. If interest rates change, or your loan type changes – say from variable to fixed – or if you have a feature such as an offset account, our system will keep track of these changes and update the monthly direct debit. This is divided by the total months in your loan term to get to your monthly repayment amount.

Our repayment calculator takes into account how much you need to borrow, the loan term (for example 30 years), and then calculates the interest charge based on which loan structure you choose.įrom there, it can work out based on the loan principal plus the interest what the total figure it is you need to pay over the loan term.įor example, if you borrowed $500,000, and your total interest charge was $350,000 over 30 years, then the total amount payable would be $850,000.

0 kommentar(er)

0 kommentar(er)